Services

We provide service by alignment of purpose, collaboration and special attention to smart digitalization.

Technology

Advanced technology solutions tailored to optimize rig operations and enhance efficiency

ERC delivers advanced drilling technology that improves performance, safety, and sustainability. By combining drilling expertise with automation, digital systems, and analytics, we help operators increase efficiency, enable remote operations, and reduce emissions

-

Best Available Technology (BAT) studies

Digital Ecosystem and IOX Interface facilitator

Automatic Drilling Control (ADC)

Parallel operations

Robotic Drilling

Remote Drilling

Autonomous Drilling

Performance tracking studies

Total Drilling time

Productive time

Non-Productive Time

-

Establish Company’s environmental management system:

ISO5001

ISO 14064

Best available technology (BAT) emission studies

Reduce Power systems loads

Reduce Base loads

Increase Productivity

Establish rig specific Energy Management Plans

Emission Reduction Initiatives (ERI)

Historical rig/well emission performance studies

Emission Forecast studies

Environment studies

Close rig studies

Emission Baseline studies

-

Best Available Technology (BAT) studies

Digital Ecosystem and IOX Interface facilitator

Automatic Drilling Control (ADC)

Parallel operations

Robotic Drilling

Remote Drilling

Autonomous Drilling

Emission Performance studies

Emission performance baseline studies

Performance tracking studies

-

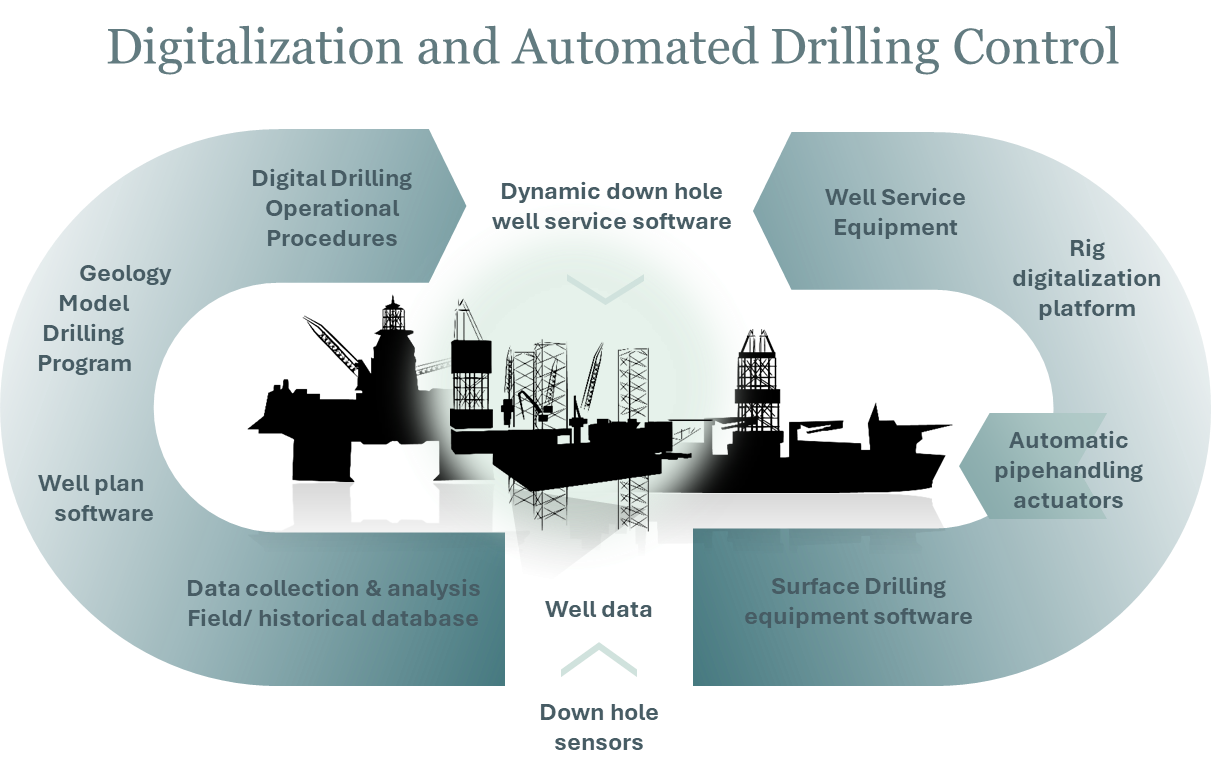

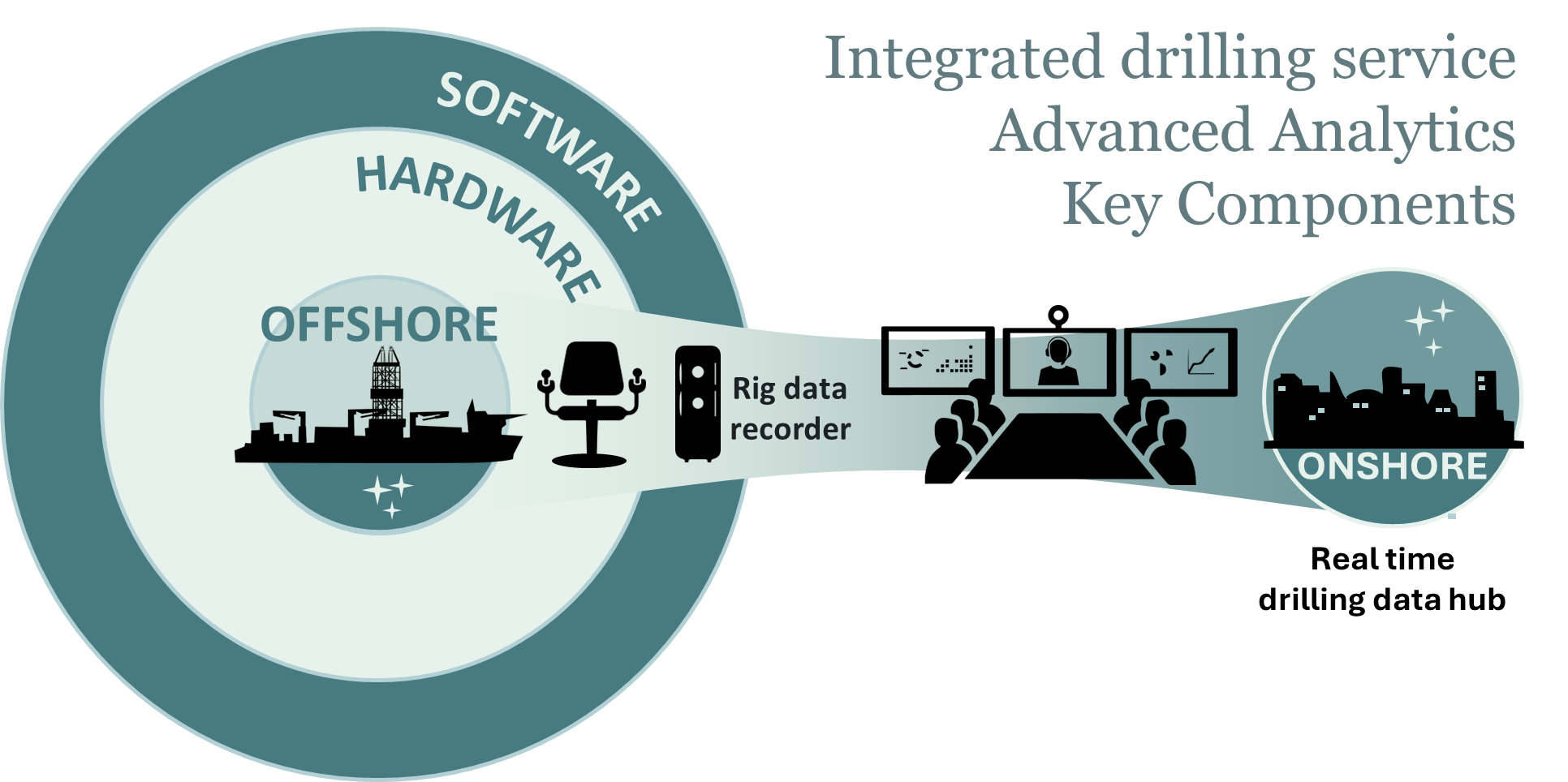

For operators and rig owners that are ready for the next step, ERC can manage and support implementation of integrated drilling service and Automatic Drilling Control (ADC) on mobile and fixed platforms.

Manage implementation of digital infrastructure on the rigs site.Manage integration of service companies' equipment into the rig’s digital infrastructure.

Coordinate integration of service companies’ control systems into the rig drilling control system

Coordinate implementation of advanced analytics and learning together with drilling company, drilling control supplier and service companies.

Coordinate and manage mobilization and operational support of ADC-operations.

-

Analyse the drilling equipment and working methods that are used on the rig. Work out solutions for automation that can improve the efficiency and the safety of the rig.

Select technology, equipment and software that will increase the uptime and safe operation of the rig, which is not outdated and has a future perspective.

Perform a calculated analysis of how the new technology will improve performance and security. Evaluate whether the chosen technology is good enough or whether you must choose another solution.

Agree with technology providers on the type of interface and communication platform to be used, for internal and external communication.

Be an overall link between the various technology companies to make sure that the collaborative solution will be optimal. This is to ensure that the technology companies talk to each other and that potential problems are discovered and taken care of.

Make sure that an Internal Acceptance Test (IAT) and a Factory Acceptance Test (FAT) are performed. Also make sure that all open punch are closed before equipment & software are delivered from the vendor(s).

Follow up installation and commissioning on the rig and ensure that the suppliers deliver the technology as intended, and make sure required documentations are updated and valid for use.

Verify that operators receive the necessary training and understanding of the new technology.

Perform a verification that the new technology delivers improvements and safety as intended

Use the trend logging system for the control system, to be able to detect any errors and to be able to make further improvements

Comprehensive concept and engineering solutions

Concept & engineering

ERC provides comprehensive, end-to-end concept and engineering development for drilling rigs and offshore production units. Our approach covers all Rig/FPSO disciplines and every phase of the project lifecycle. From early concept to detailed design, we convert operational requirements into practical, compliant, and automation-ready solutions that reduce risk, enhance performance, and create long-term value across the asset lifecycle.

-

Develop SPS / Rig Mobilization Scope of Work (SOW)

Creation of a complete and structured SOW tailored to project objectives and rig-specific requirements.

Identify Gaps Against Class, Flag, and Authority Requirements

Execution of comprehensive gap assessments and development of SOW elements addressing compliance with applicable Class, Flag State, and regulatory authority standards.

Identify Gaps Against NCS Acknowledgement of Compliance (AoC) Requirements

Detailed evaluation of NCS AoC requirements, followed by development of corresponding scopes to ensure full regulatory alignment.

Identify Gaps Against UK Safety Case Requirements

Thorough assessment of UK Safety Case requirements and preparation of aligned SOW elements to secure compliance within the UK regulatory regime.

Develop Client Provided Items (CPI) Scope of Work

Definition and documentation of CPI responsibilities, interfaces, and delivery expectations to ensure clarity across all stakeholders.

Establish Project Delivery Acceptance Criteria

Development of measurable and verifiable acceptance criteria supporting consistent, compliant project execution and handover.

Develop Commissioning and Acceptance Test Procedures

Preparation of structured commissioning plans and acceptance test procedures to confirm system readiness, functionality, and regulatory compliance.

-

Screening & Feasibility studies

Concept Design studies

Front End Engineering Design (FEED) studies

Reactivation FEED/Detail engineering studies

3’rd party project status and review reports

-

Industry requirements

Authority requirements, ( NCS, Canada, Brazil etc.)

Flag state requirements, (Canada, MNA, Bahamas etc.)

Class Requirements, (DNVGL, ABS etc.)

Operator specific requirements

Activity related requirements

ESG requirements

-

Advisory Services, i.e. Studies of regional regulations impact on the business case or design.

Compliance studies

PSA

Norsok

Class – DNV

NMA

Brazillian compliance: Electrical NR10, Machinery NR12, pressurized systems NR13, Helideck NR27

-

Risk and Barrier management

Technical safety

Hull and structures

Pressurized systems / process plant

Life extension studies

Lifting equipment

RBI program – EX and HP/LP pipe

-

Material handling studies

DROPS philosophies and guidelines

Safe working site follow ups

DROPS follow up of package vendors and installation

DROPS training

Pre-Drops / Make Safe Campaign

NCS AOC and UK Safety case process

End-to-end project management

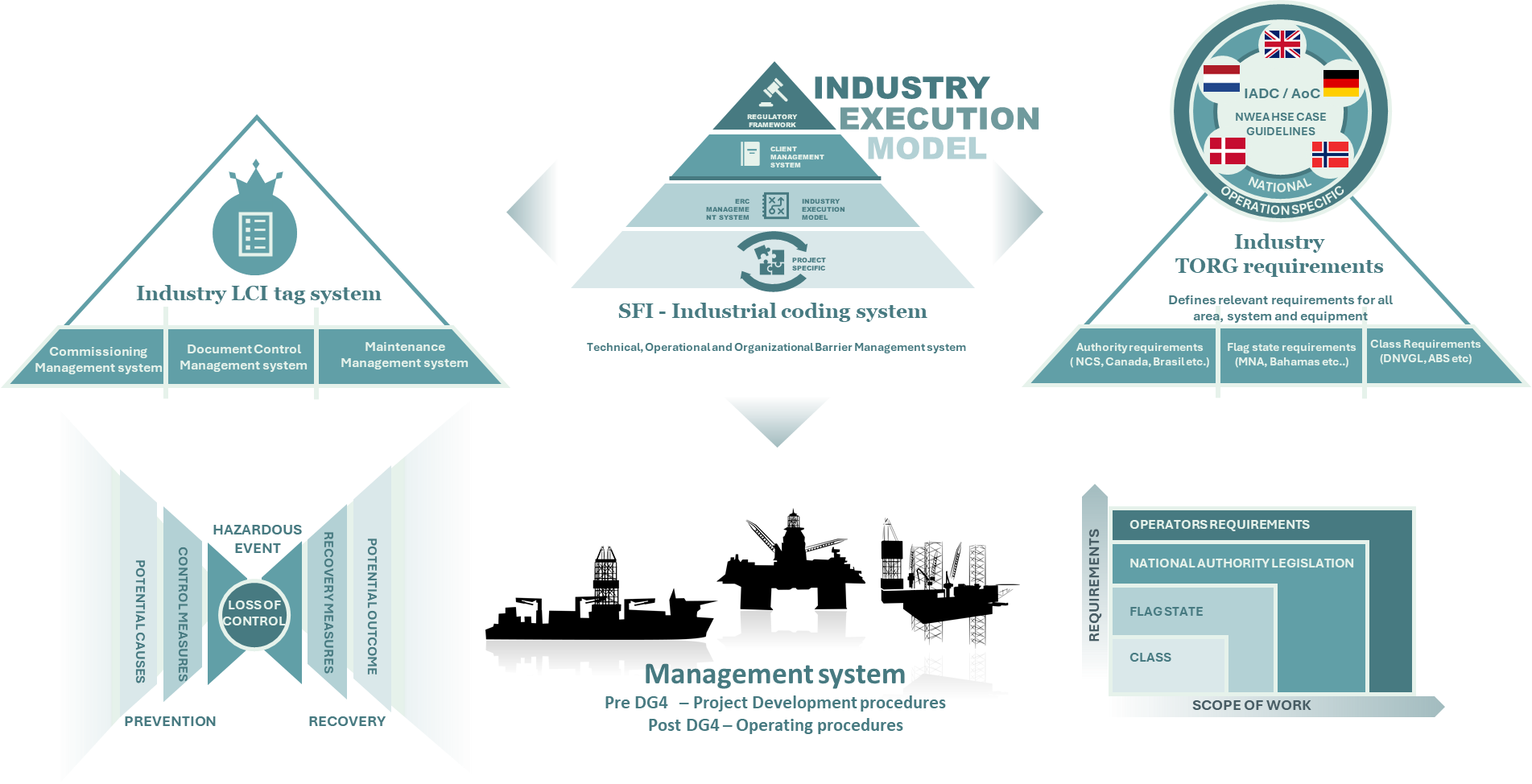

Utilizing the industry delivery model and regulatory compliance framework for offshore projects and operations.

Project management

ERC provides project management services for complex rig projects, covering M&A due diligence, SPS, and rig mobilization. With deep expertise in cost, risk, and regulatory management, we act as the owner’s representative to deliver safe, efficient, and predictable outcomes from day one.

-

NCS Authority-, Flag- and DNV Class requirements + Company activity requirements

Mature FEED & TBS - Proven design concept and applied technologies

Approved Engineering alliance, aligned MEL and unique Aker BP requirements.

Yard is FEED/Design responsible.

Yard is responsible for all MC & Completion activities

Defined Accept criteria

Defined commissioning program

Defined TQ/VO/Punch management system

Late delivery payment incentives

-

Company’s main responsibilities:

Managing the yard during detailed engineering and execution phases under Industry EPCIC (Engineering, Procurement, Construction, Installation and Commissioning) delivery models.

Supports the development of industry-aligned project strategies, ensuring compliance with class, flag state and regulatory authority requirements.

Manage contract strategies and project risk, monitor class, statutory and regulatory documentation status.

Ensure alignment with operator and client acceptance requirements.

Contractual and technical specification compliance throughout the project lifecycle.

Supporting safe, efficient and predictable project execution.

-

Yard contract

Technical Building Specification.

Yard is FEED/Design responsible.

Yard is responsible for all MC & Completion activities

Defined Accept criteria’s

Defined commissioning program

Defined TQ/VO/Punch management system

High tail end delivery payment schedule

High liquidated damage

Company takes ownership at time of delivery from yard

Company payment is guaranteed with performance bond

Bank guaranty of contract price through 2 years warranty

-

DG1-DG2

Prequalify yards and operational management companies.

Define prequalified FEED/Detail engineering companies

Prequalify main equipment subcontractors (MEL)

Approved Engineering alliance, MEL and TORG requirements.

DG2-DG3

Ownership of SOW (FEED&TBS)

EPCIC turn-key delivery responsibility

Commissioning management system

Document Control, LCI and Maintenance Management system

Authority-, Flag- and DNVGL Class requirements and notations

Mature FEED & TBS

DG2-DG3

EPCIC project following up strategy

DG4-Operation

Asset operational management strategy

-

Rig intake Project Service reports

Phase 1, pre-hire check

Phase 2, full condition survey

Phase 3, full acceptance test

Rig intake reports:

Rig performance benchmarking reports

Well performance benchmarking reports

Contract Strategy

Rig Inspection, Verifications and Acceptance reports

Commissioning procedures

Acceptance Test Procedures.

System Integration Test Procedures

-

Providing senior QRM/HSE service, managing project and operational risk activities.

-

ERC helps owners, boards, and investors understand risk, value, and opportunity—before critical decisions are made. We conduct comprehensive clarity evaluations before a transaction — when insight matters.

Condition gapping surveys of Mobile Units in accordance with AOC/HSE regulations

Technical Due Diligence (TDR) reports.

Rig-specific and/or fleet insights, along with deep rig status reviews

Ranking/performance analyses

Operational services

Operational Service

ERC delivers Marine, Drilling, Subsea, and Well Control operational services for offshore assets. We support the planning and execution of complex operations, ensuring safe, efficient, and fully compliant performance across the asset lifecycle. By combining hands-on operational expertise with rigorous engineering discipline, ERC helps clients reduce risk, meet regulatory requirements, and achieve reliable offshore execution.

-

Having in-depth knowledge of the capabilities and limitations of most rig designs in the market

Having extensive experience from establishing and managing complex contracts and charter parties

Having a business model focusing on cost-efficient project execution for clients and partners

-

ERC offers marine operations services using business models catered to suit the individual client’s needs, ranging between:

Specialist services for individual work packages in projects, provided by one ERC personnel integrated in clients’ project teams

A to Z management of the marine operation, provided by a team of ERC personnel under an engineering, procurement and management assistance (EPMA) framework

The key element in ERC’s marine operations management business model is identifying our clients’ best execution models.

-

Marine engineering and –analyses services offered by ERC and strategic partners include:

Motion response analyses

Mooring analyses

Site-specific analyses for jack-up rigs

Riser analyses

Lifting analyses

Operability analyses

Operational procedures for marine operations

-

Marine advisory services offered by ERC and strategic partners include:

Third party verification

Incident investigations

Technical- and commercial procurement assistance, including development of combined technical- and commercial evaluation models

Marine assurance including vessel inspections and audits of vessel management

Cold eyes review

Development of go / no-go criteria for marine operations, using combined technical- and commercial evaluation models

-

Drilling operations planning and execution support (onshore and offshore)

Owner’s drilling representative (Drilling Supervisor / Company Man support)

Well delivery and integrated drilling operations support

Drilling performance optimization and NPT reduction initiatives

Rig intake, start-up, and operational readiness programs

Operational procedures, manuals, and barrier management documentation

Risk assessments, HAZID / HAZOP / WellOps risk workshops

Rig-specific drilling philosophy and operational envelope definition

Managed pressure drilling (MPD) operational support and readiness

Well control preparedness, drills, and verification

Contractor and service company interface management

Operational assurance, audits, and compliance verification

Real-time drilling operations support and remote monitoring readiness

Lessons learned capture and continuous improvement programs

-

BOP and Well control systems support

Subsea operations planning and execution support (onshore and offshore)

Owner’s subsea representative / subsea engineer support

Subsea Production System (SPS) operational readiness and start-up support

Installation, testing, commissioning, and handover support for subsea systems

Subsea well intervention and workover planning support

Subsea equipment operability, maintainability, and reliability assessments

Interface management between drilling, marine, and subsea contractors

Subsea operational procedures, philosophies, and contingency planning

Risk assessments, HAZID / HAZOP / SIMOPS for subsea operations

Subsea barrier management and verification

Vessel and rig selection support for subsea campaigns

Subsea operational assurance, audits, and compliance verification

Lessons learned capture and continuous improvement programs for subsea operations

Advisory services

M&A and transaction service

We provide board- and investor-level advisory on joint ventures, JVs, M&A due diligence and strategic transactions, including acting as a strategic advisor in the negotiation and execution of contracts with E&P companies

-

Clarity before a transaction — when insight matters:

Our services include:

M&A advisory

Buy-side and sell-side due diligence

Strategic transaction reviews

Board- and owner-level decision support

Technical Due Diligence report

Software-based rig ranking/performance analysis report

M&A reports

Technical Due Diligence Reports

Executive Summary

Asset Description and Status

Regulatory, Class, and Certification

Structural and Marine Integrity

Drilling, Well Control, and Safety-Critical Systems

Power, Electrical, and Control Systems

Maintenance, Reliability, and Integrity Management

Capital Expenditure and Cash Risk

Market Readiness and Value Protection

Risk Assessment

Documents and Acceptance requirements

Conclusions and Recommendations

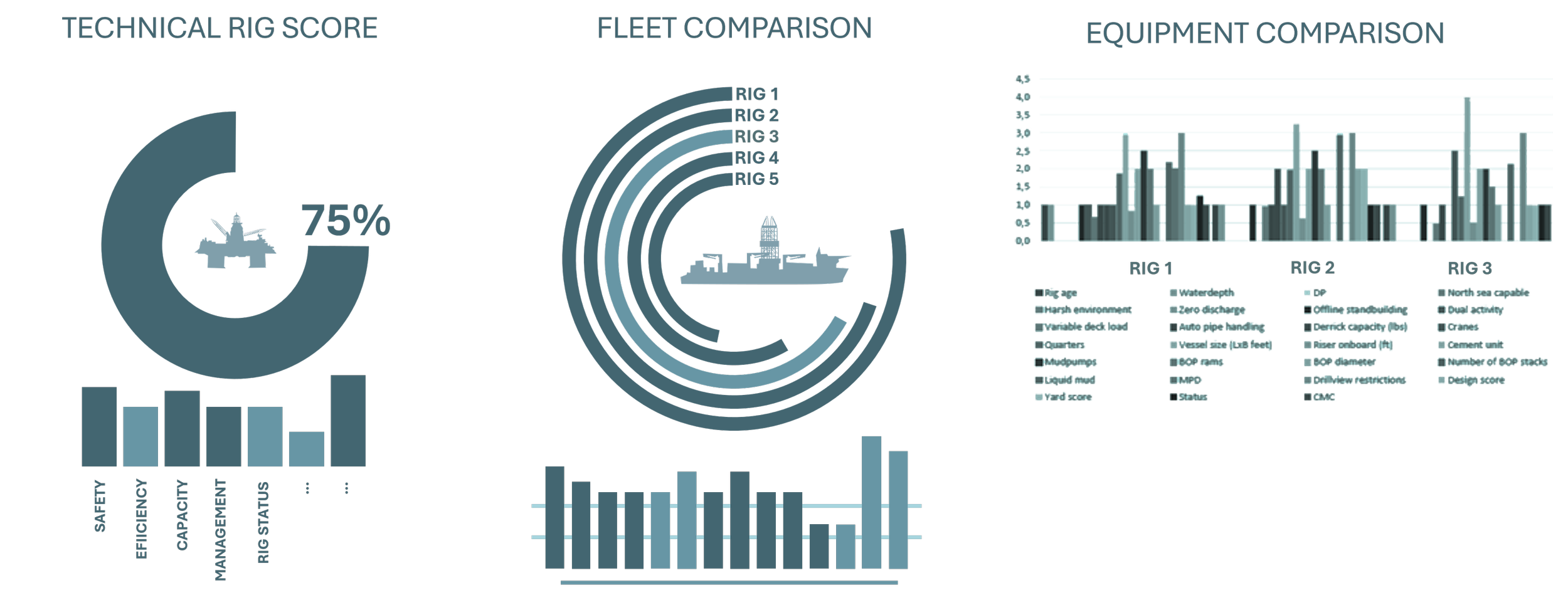

Software-based rig ranking/performance analysis (RigCalc) report:

Technical rig score

Fleet comparison

Equipment comparison

-

ERC provides independent expert witness and technical advisory services to support litigation, arbitration, and dispute resolution, particularly within Oil & Gas, energy, and complex industrial projects.

Our services include:

Expert Witness Services

Independent expert opinions, preparation of expert reports, and oral testimony in court and arbitration proceedings, including support during cross-examination.Technical and Commercial Dispute Advisory

Analysis of technical failures, delays, cost overruns, performance issues, and compliance with contracts, regulations, and industry standards.M&A and Transaction-Related Disputes

Technical assessment of representations and warranties, post-closing claims, earn-out disputes, and expert determination processes.Quantum and Damages Support (Technical Input)

Technical basis for loss and damage assessments, including CAPEX/OPEX analysis, asset valuation, remaining life, and performance impact.Strategic Support to Legal Teams

Technical support to counsel, review of opposing expert reports, development of technical arguments, and preparation for hearings and mediation.Independent Reviews and Second Opinions

Peer reviews of expert reports and independent technical assessments to support settlement discussions and dispute resolution.

-

Ensure that Rig technical specification is developed in compliance with E&P Company’s expectations.

Define the Rig upgrade SOW and execution plan

Develop Rig-specific assessment and fleet comparison

Tailor-make the rig presentation to the E&P company’s well program

Develop a strategy for negotiations and execution of rig service contracts with E&P companies

Courses

Professional Training Programmes for personnel involved in Drilling rigs, Well operations, Industry delivery model, and Regulatory compliance framework

Why Choose Our Courses?

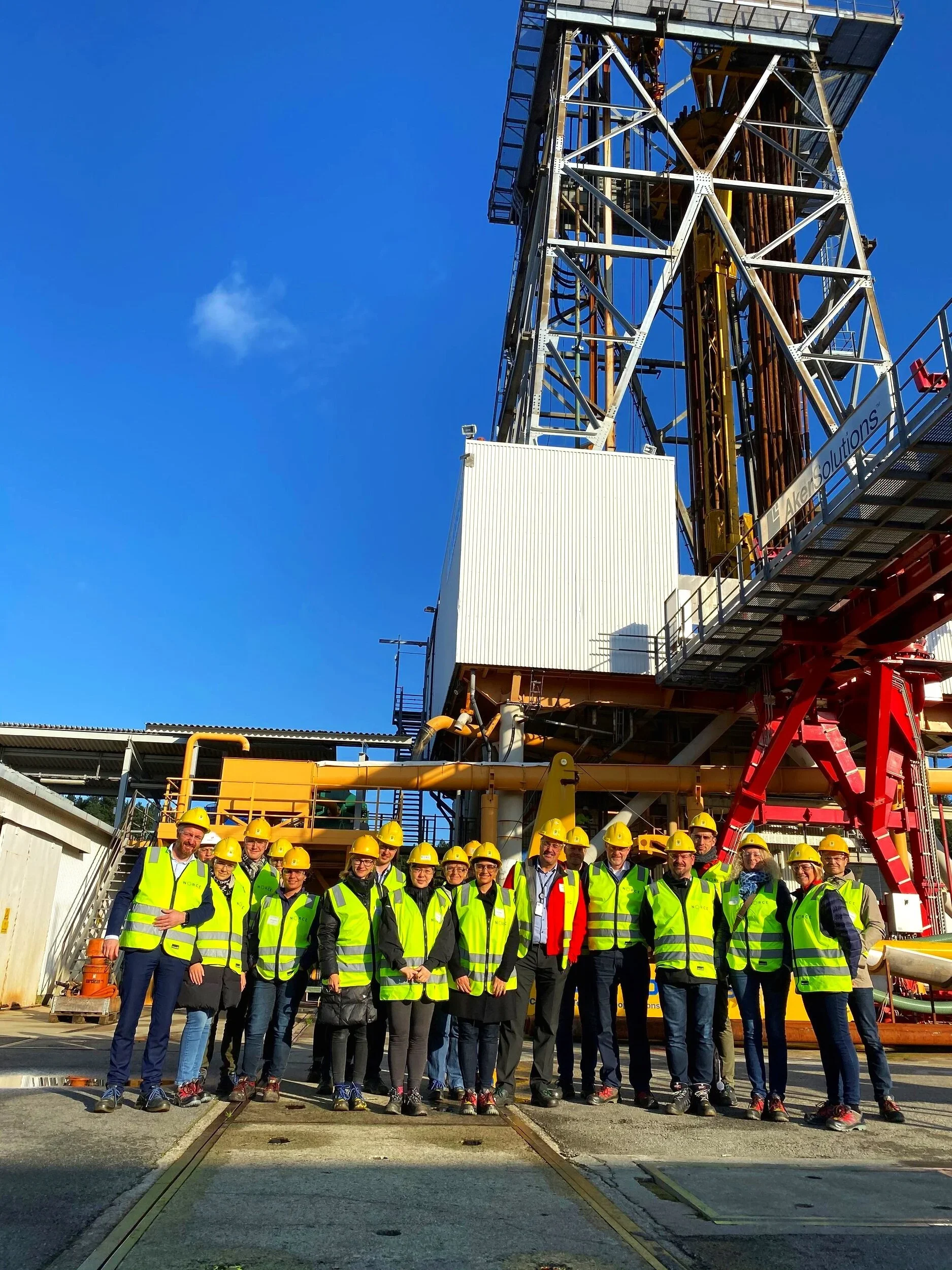

Expert-led training with real-world applications

Hands-on experience at industry-leading facilities

Comprehensive coverage of technical, regulatory, and operational aspects

Ideal for professionals and graduates seeking to enhance their expertise in Drilling rigs, Well operations, Industry delivery model, and Regulatory compliance framework

Lecturer

The lecturer and responsible publisher of this compendium is Geir Ove Eikill. He has 15 years as responsible course lecture for Equinor’s Rig and Equipment courses, and Industry Project Management course module.

The ERC training course modules have been a compulsory part of EQN’s graduate training program for all newly recruited Safety, Project, Procurement, and D&W employees over the last 15 years.

-

Module 1 : RIGS AND DRILLING EQUIPMENT

Duration: 3 days

Overview:

This module offers a comprehensive introduction to drilling operations, rig types, concepts, and the systems and equipment that power modern drilling activities. It includese exclusive hands-on experience observing live drilling operations at the Ullrigg facility in StavangerCourse Objectives:

Participants will develop a solid understanding of rig activity, capacity, and safety requirements across various drilling operations. Key focus areas include:- Fundamentals of drilling methods

- Drilling systems and equipment

- Field development solutions

- Maritime systems integration

- Environmental impact and emissions control

- Digitalisation and remote/automated drilling technologies

- Maintenance systems for operational reliability

Target Audience:

- New hires and graduates

- Rig Engineers

- Drilling Engineers

- HSE professionals

- Contract & Procurement personnel involved in Drilling & Well activities

-

Module 2: RIG INTAKE PROCESS

Duration: 2 days

Overview:

This module covers the rig procurement and technical selection processes essential for successful drilling and well operations from fixed and mobile platforms.Course Objectives:

Participants will gain strategic insights into rig selection and compliance requirements, focusing on:- Industry regulatory safety standards (Class, Flag, and Authority AoC regulations)

- Efficiency, flexibility, and CO₂ reduction strategies

- Rig procurement processes

- Industry rig intake execution model

Target Audience:

- Rig Engineers

- Drilling Engineers

- HSE professionals

- Contract & Procurement personnel directly involved in strategic drilling and well activities

-

Module 3: THE INDUSTRY DELIVERY MODEL

Duration: 1 day

Overview:

This module provides an understanding of the industry delivery model and regulatory compliance framework for offshore projects and operations.Course Objectives:

Participants will learn about Industry regulatory safety standards and project execution strategies:1. Industry regulatory fundamentals

- Industry regulatory safety standards (Class, Flag, and Authority AoC regulations)

- HSE Safety Case (UK)

- AoC model (NCS)

2. Industry project & operation model

- EPCIC Turn-Key contract model

- Execution strategy and management systems

Target Audience:

- New hires and graduates

- Project Managers

- Procurement and Contract Personnel

-Engineers involved in upgrade projects or Mobile Offshore Unit new builds